Cyber Insurance: Safeguarding Business in the Digital Age and Beyond

With cybercrime damage projected to hit $10.5 trillion by 2025, Deloitte's report highlights the urgent need for cyber insurance as the Indian market rapidly expands

23-07-2024With cybercrime damage projected to hit $10.5 trillion by 2025, Deloitte's report highlights the urgent need for cyber insurance as the Indian market rapidly expands

23-07-2024The present time has witnessed a surge in the number of cybercrimes. According to McKinsey & Company, at the current growth rate, damage from cyber-attacks will amount to about $10.5 trillion annually by 2025—a 300 percent increase from 2015 levels. The impact of data breaches, data loss, or data theft can be devastating, leading to the loss of customers, damage to a company's reputation, and a decline in revenue. Due to this rapid increase in cybercrimes, cyber insurance becomes imperative for protecting the financial interests of businesses of all sizes.

Cybersecurity insurance, also known as cyber insurance, is a product designed to help companies to manage the threats related to cybercrime, such as cyberattacks and data breaches. It safeguards the companies against the expenses incurred due to cybercrimes that affect the IT segment, information management, and data policies generally not covered by traditional policies. Moreover, businesses must be held accountable for the damages caused by the loss or theft of third-party data. A cyber insurance policy can provide protection against a range of cyber incidents, including cyber terrorism, and support the recovery and resolution of security breaches.

Deloitte's recent report, "Cyber Insurance in India: Navigating risk and opportunities in a digital economy" gives an account of those industries that are rigorously employed in digital transformation like Information Technology, pharmaceuticals, and manufacturing, and those interconnected with the wider economy, like supply chain, retail, critical sectors, and finance. They are prime targets for cybercriminals. These sectors are often early adopters of cyber insurance. This report highlights that the Indian cyber insurance market is currently valued at $50–60 million and has experienced a consistent compound annual growth rate (CAGR) of 27–30% over the past three years. This trend is expected to persist for the next three to five years, driven by growing awareness of the importance of cyber insurance. Even the Insurance Regulatory and Development Authority of India (IRDAI) has established a standing committee to continually assess cyber security threats related to current and emerging technologies. Formed after the issuance of the Information and Cyber Security Guidelines, 2023, this committee will also recommend changes to enhance the cyber security framework and resilience within the insurance industry.

Cyber insurance can broadly be classified into two types. first-party and third-party coverage. First-party cyber liability insurance covers financial losses a business incurs from cyberattacks on one's own network or systems. Second, Third-party cyber liability insurance helps in covering legal expenses arising from cyberattacks on a client's network or systems. However, in order to provide specific safety against cyber-security, risks faced by organizations and individuals, there are other specialized types of cyber insurance, such as errors and omissions, network security, data breach, incident response, and supply chain risk insurance.

A cyber insurance policy aids organizations in covering financial losses as a result of cyberattacks or data breaches, as well as costs associated with remediation. This includes expenses for investigations, crisis communication, legal services, and customer refunds. Typically, cyber insurance offers first-party coverage for losses from data destruction, hacking, extortion, and theft, and may also include legal expenses. Specific coverage areas vary among providers but commonly include: notifying customers about breaches involving personally identifiable information (PII), restoring affected customers' identities, addressing unauthorized data breaches, recovering compromised data, repairing system damages, and managing liability for losses involving business partners with access to data. Cyber insurance is essential for mitigating financial risks associated with cyber incidents and ensuring organizations can recover swiftly and responsibly.

Cybersecurity insurance policies typically exclude coverage for issues that were preventable or caused by human error or negligence. This includes incidents arising from poor security processes, such as ineffective configuration management or breaches that occurred before the policy was purchased. It also does not include the coverage of insider attacks and cyberattacks resulting from employee mistakes. Policies also exclude breaches caused by preexisting vulnerabilities that the organization failed to address, as well as costs associated with upgrading or improving technology systems, like enhancing application and network security.

In India, the aforementioned statistics suggest the cyber insurance market is growing leaps and bounds but certain challenges still remain unaddressed. A large number of businesses remain unaware of the significance of cyber insurance and the potential repercussions of cyberattacks. Therefore, spreading awareness through campaigns and policies regarding it is important. The inadequacy of cyber insurance policies can expose businesses to huge financial risks. Moreover, high premiums associated with cyber insurance can be prohibitive for small and medium-sized enterprises, limiting their ability to afford adequate coverage against cyber threats. Insurers have a hard time pricing cyber risks because it's difficult to understand the potential damage and costs if a cyber incident happens. Unlike physical damage, such as to a vehicle or property, where losses can be estimated, cyber threats are less predictable because they can cause widespread issues affecting many stakeholders at once. This unpredictability makes it hard for insurers to assess the risk profiles of their clients. Moreover, it's challenging for insurers to thoroughly test and evaluate the digital tools and potential cyber threats that buyers might face. The fast pace of technological changes and increasingly sophisticated cybercrimes are making traditional methods of assessing these risks outdated. This adds to the difficulty for insurers in accurately pricing cyber insurance policies.

Cyber insurance is becoming increasingly important in the global market as businesses and individuals recognize the growing threat of cyberattacks. Many countries are devising effective framework regarding cyber insurance to tackle the cybercrimes. The US department of Homeland Security has worked towards creating a conducive environment where cyber insurance promotes adoption of preventive measures and best practices in return for better coverage and premiums. Even the EU- GDPR is increasing awareness about data privacy and the demand for cyber insurance.

Cyber insurance has become an indispensable tool for businesses navigating the digital landscape. As cyber threats continue to escalate in complexity and frequency, the importance of having robust cyber insurance cannot be overstated.

This insurance not only helps mitigate the financial impact of cyberattacks and data breaches but also supports the remediation processes essential for recovery. Coverage typically includes costs related to data recovery, system repairs, legal fees, and customer notifications, making it a comprehensive safeguard against various cyber risks. The growth of the cyber insurance market reflects an increasing awareness of its necessity. This trend is likely to continue, driven by the relentless pace of digital transformation and the corresponding rise in cyber threats.

In conclusion, cyber insurance serves as a critical component of a robust cybersecurity strategy. It provides businesses with the financial resilience needed to withstand cyber incidents and ensures they can swiftly recover and continue operations. As cyber risks evolve, so will the importance and scope of cyber insurance, making it a vital investment for any organization.

- The author is a research scholar specializing in cyber laws at the Faculty of Law, University of Lucknow.

A Delhi court acquitted former Chief Minister Arvind Kejriwal and several others in the liquor polic

Read More

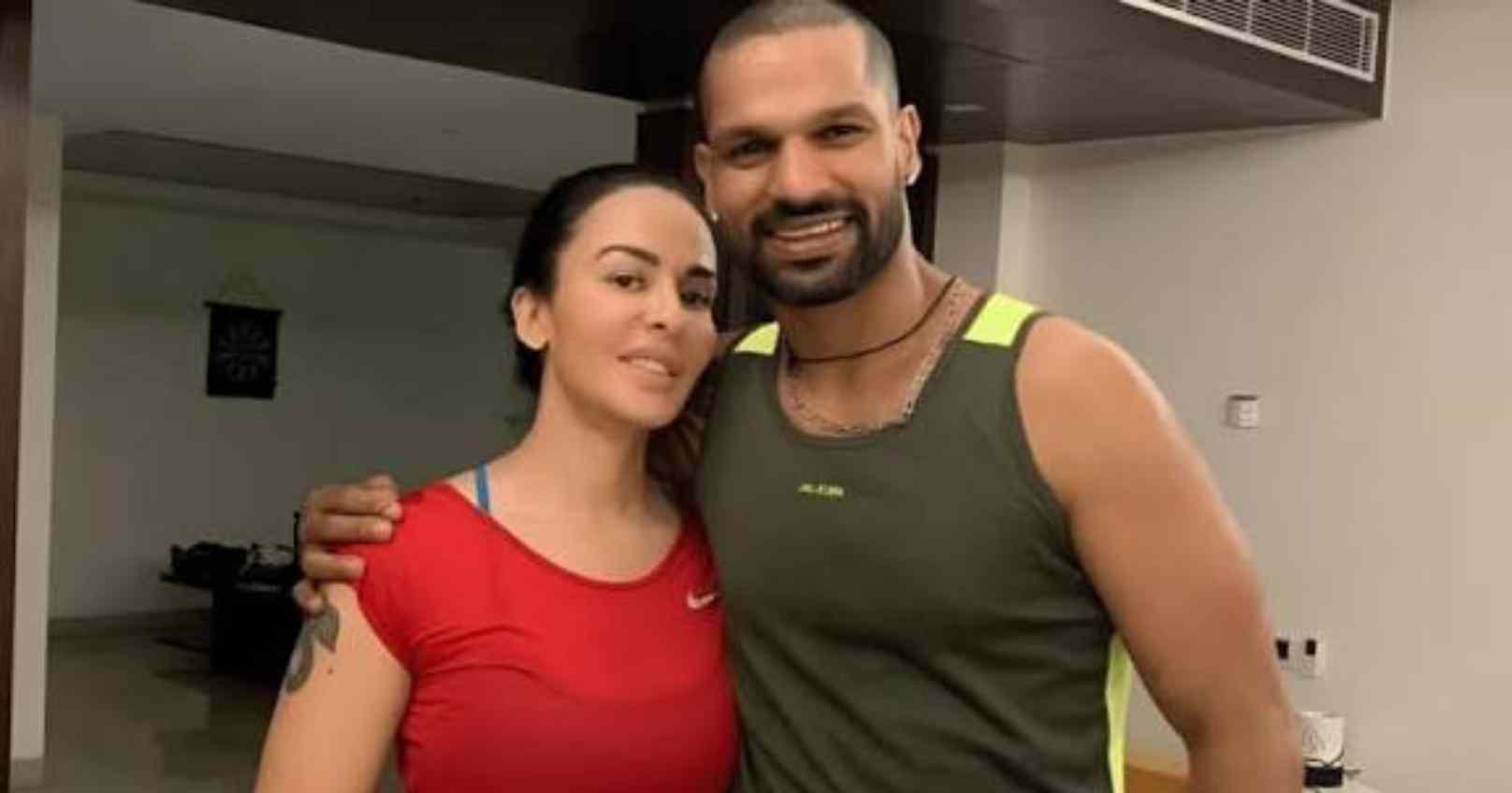

A Delhi family court has ruled that the Australian property settlement between cricketer Shikhar Dha

Read More

The Supreme Court has advised political parties to avoid using the judiciary for electoral rivalries

Read More