The Indian government has announced adjustments to its tax policies concerning the energy sector, notably reducing the windfall gains tax on domestically produced crude oil and maintaining nil export duty on petrol, diesel, and aviation turbine fuel (ATF).

The Centre has decided to decrease the windfall gains tax on domestically produced crude oil from Rs 8,400 per tonne to Rs 5,700 per tonne, aiming to ensure competitiveness in the energy sector while balancing the taxation structure.

Additionally, the government has chosen to continue the export duty on petrol, diesel, and ATF at nil to support the export competitiveness of these essential energy products.

These changes, effective from May 16, 2024, were announced by the Central Board of Indirect Taxes and Customs (CBIC) through a late-night notification on Wednesday, providing stakeholders with clarity on the implementation of the revised tax policies.

Prior adjustments to the windfall gains tax on domestically produced crude oil were made on May 1, 2024, when the tax was revised to Rs 8,400 per tonne from Rs 9,600 per tonne, reflecting ongoing efforts to optimize the taxation structure in response to market dynamics.

Introduced on July 1, 2022, windfall profit taxes in India are aligned with global practices and are reviewed every fortnight based on fluctuations in international crude oil prices over the preceding two weeks.

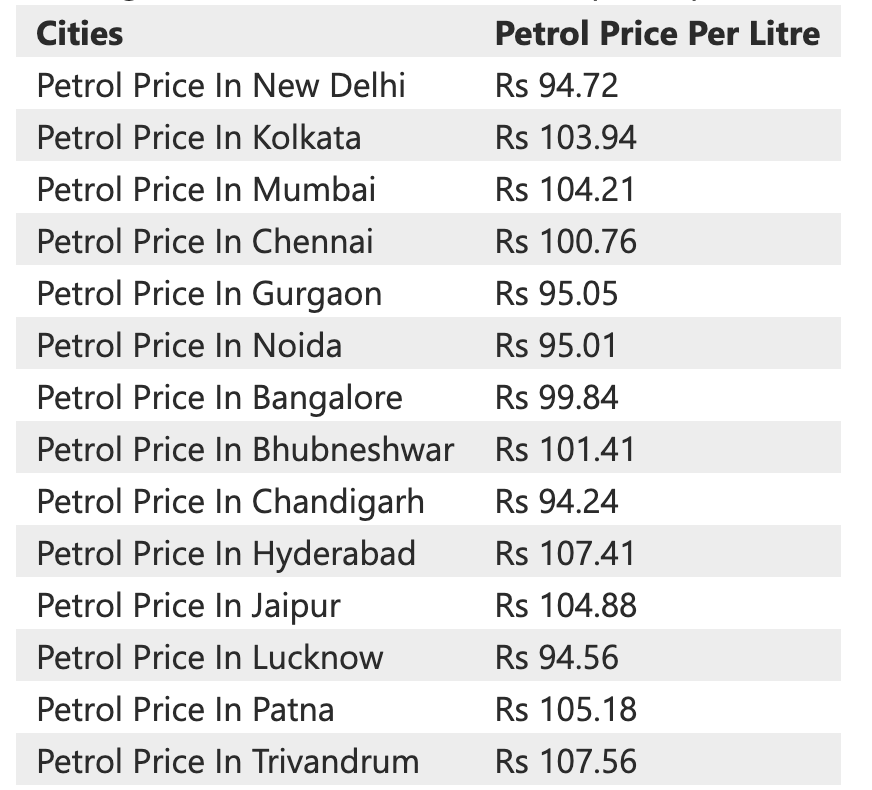

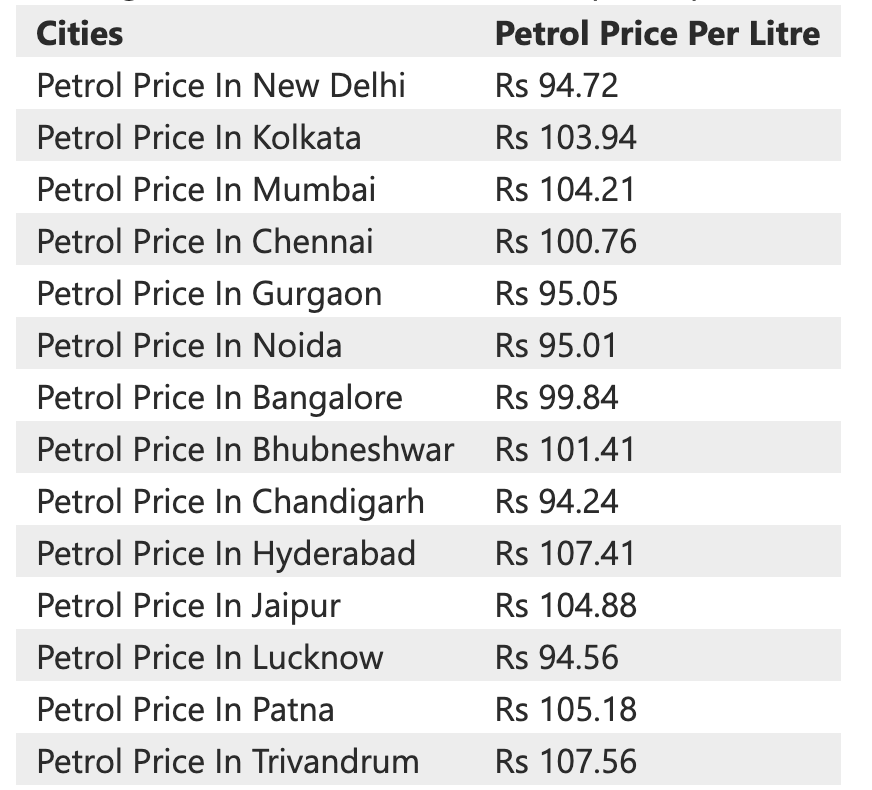

Petrol prices in Indian cities remained stable and ranged between Rs 94 to Rs 107 per litre, influenced by factors such as international crude oil rates, domestic taxation systems, and currency exchange values.