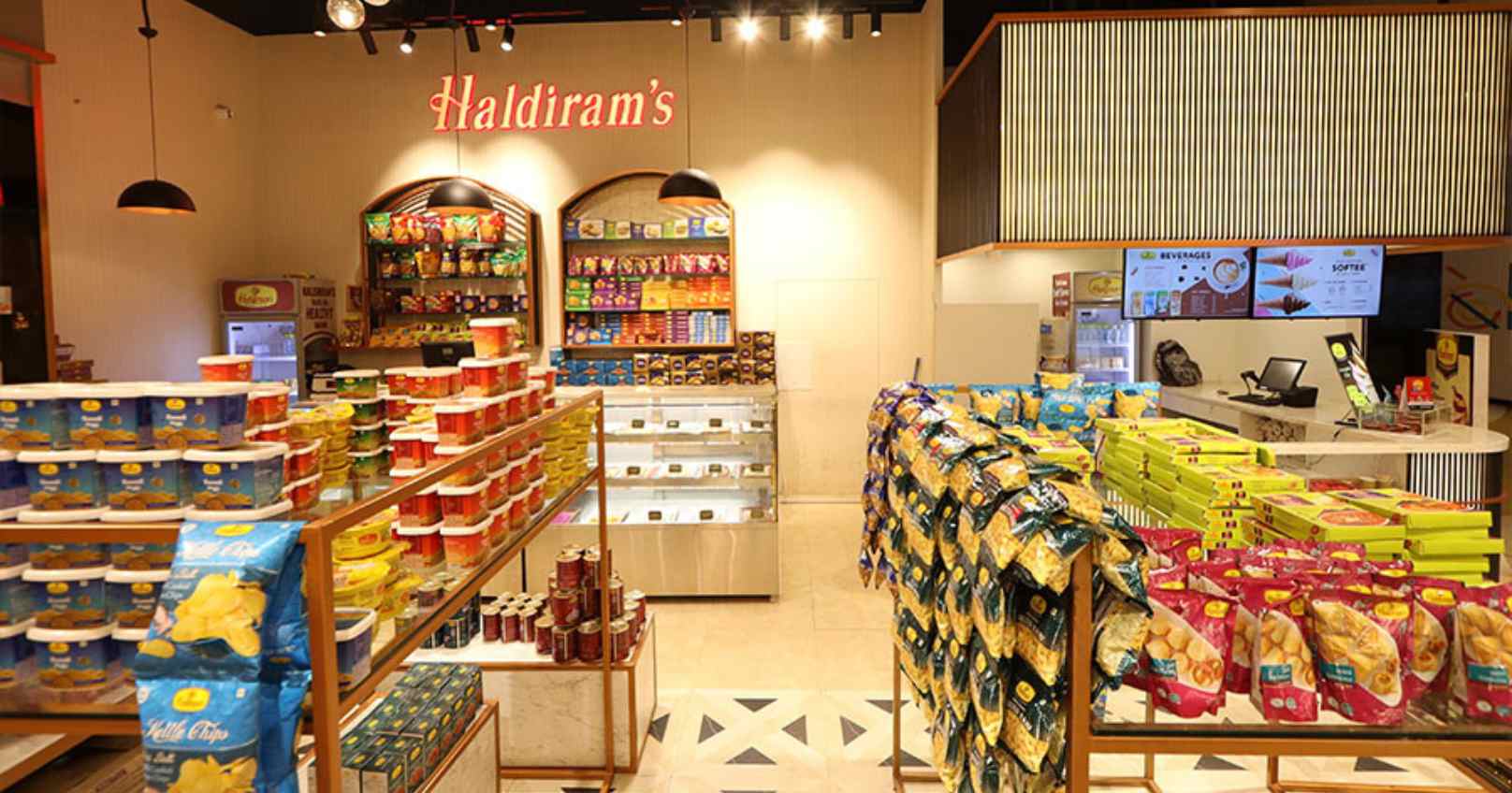

Haldiram’s has caught the attention of global investors once more, with Singapore's state investment firm, Temasek Holdings Pte, reportedly in discussions to acquire a minority stake in Haldiram Snacks Pvt Ltd. According to Bloomberg, Temasek is considering purchasing a stake ranging from 10% to 15% in the company, which is currently valued at around $11 billion. This potential investment could pave the way for Haldiram’s public listing in the future.

Growing Interest from Private Equity Firms

This development follows a wave of interest from prominent private equity players, including Blackstone and Bain Capital, who have expressed a desire to acquire a stake in the renowned Indian snack brand. Earlier in May 2024, reports indicated that Blackstone, in collaboration with the Abu Dhabi Investment Authority (ADIA) and Singapore’s GIC, had placed a bid to acquire up to 76% of Haldiram Snacks Food Pvt Ltd. That bid valued Haldiram’s between ₹70,000 crore and ₹78,000 crore, marking it as one of the largest potential transactions in India’s food and snack industry.

Potential IPO on the Horizon

The ongoing discussions with Temasek come at a crucial time for Haldiram’s as the company seeks to explore its growth potential. Should these talks progress, it could facilitate the company’s journey toward an initial public offering (IPO). However, the discussions are still in the early stages, and there is no assurance that a deal will be finalized.

A Rich Legacy and Expanding Global Presence

Haldiram’s has long been an attractive investment target, with numerous firms like Bain Capital, Warburg Pincus, and General Atlantic showing interest over the years. Founded in 1937 as a modest sweets and snacks shop in Bikaner, Rajasthan, the company has since evolved into a significant player in the global market. Haldiram’s products are now available in over 80 countries and are staples in many Indian households and diaspora communities worldwide.

Merger of Operations for Enhanced Efficiency

The Haldiram’s business comprises two primary branches, led by different factions of the Agarwal family: Haldiram Foods International, headquartered in Nagpur, and Haldiram Snacks Pvt Ltd, based in Delhi. Both branches are set to merge and establish a new entity called Haldiram Snacks Food Pvt Ltd, aimed at streamlining operations and boosting efficiency.

Financial Performance Highlights

Regarding financial performance, Haldiram Foods International reported revenues of ₹3,622 crore for the financial year 2022, while Haldiram Snacks Pvt Ltd recorded sales of ₹5,248 crore during the same period. This robust financial performance further underscores Haldiram's position as a leading brand in the Indian snack industry.