The Benefits of Corporate Trustees: Why Consider Professional Fiduciary Services

Unlocking the value of corporate trustees: Advantages and insights for asset management

07-05-2024Unlocking the value of corporate trustees: Advantages and insights for asset management

07-05-2024Introduction

When it comes to managing assets wealth and estates individuals and businesses often require assistance to ensure their interests are protected and their goals are met. A valuable resource in this regard is the use of corporate trustees also known as professional fiduciaries. These specialized entities offer a range of benefits and expertise that can help safeguard and optimize the management of assets. In this blog post we will explore the advantages of considering professional fiduciary services and the value they bring to individuals and organizations.

Expertise and Experience

One of the significant advantages of engaging a corporate trustee is their substantial expertise and experience in the field of fiduciary responsibilities. Professional fiduciaries are well-versed in various financial matters estate planning tax regulations and legal aspects related to asset management. Their knowledge and understanding can help navigate complex financial landscapes ensuring proper administration and adherence to legal and regulatory requirements.

Objective Decision-Making

Corporate trustees bring an additional layer of objectivity to asset management. Unlike family members friends or internal staff who may have personal biases or conflicts of interest professional fiduciaries prioritize the best interests of their clients. They make decisions based on sound judgment and professional responsibility effectively removing emotional attachments that can potentially cloud decision-making processes.

Continuity and Stability

An individual acting as a trustee may encounter unexpected life events such as illness or death which can disrupt the continuity of fiduciary responsibilities. In contrast corporate trustees provide stability and continuity in the management of assets. They have well-established systems and structures in place to ensure seamless transitions regardless of personal circumstances or staff changes.

Risk Mitigation

Professional fiduciaries are well-versed in managing risk and protecting clients' interests. They have the ability to analyze and evaluate investment options reducing the risk exposure of the assets under their care. Corporate trustees also have strict internal control mechanisms risk management policies and compliance protocols in place to safeguard against fraudulent activities or mismanagement of assets.

Knowledge of Legal and Regulatory Frameworks

Laws and regulations surrounding financial management tax planning and estate administration are constantly evolving. Corporate trustees stay up-to-date with these changes and ensure compliance with legal and regulatory frameworks. By working with professionals who have an in-depth understanding of the legal landscape clients can have peace of mind knowing that their assets are managed in accordance with the law.

Enhanced Estate Planning

Corporate trustees can bring specialized expertise to estate planning strategies assisting in the smooth transition of assets from one generation to the next. They can work closely with attorneys and other professionals to develop comprehensive plans that address tax implications wealth preservation philanthropic initiatives and the specific goals of their clients.

Confidentiality and Privacy

Maintaining confidentiality and privacy is crucial especially when it comes to matters of wealth and estate planning. Corporate trustees have robust policies in place to protect the privacy and confidentiality of their clients. They are bound by legal and ethical obligations to maintain strict confidentiality about the assets and affairs of their clients.

Conclusion

Engaging the services of a corporate trustee offers numerous benefits that transcend individual or organizational boundaries. Professional fiduciaries bring extensive expertise objectivity and stability to the management of assets ensuring clients' interests are protected and their goals are met. With their in-depth knowledge of legal and regulatory frameworks risk mitigation strategies and comprehensive estate planning capabilities corporate trustees contribute significantly to the smooth and efficient management of wealth and estates. Considering professional fiduciary services is a wise move for those seeking to optimize the management of their assets while maintaining the highest standards of professionalism and confidentiality.

A Delhi court acquitted former Chief Minister Arvind Kejriwal and several others in the liquor polic

Read More

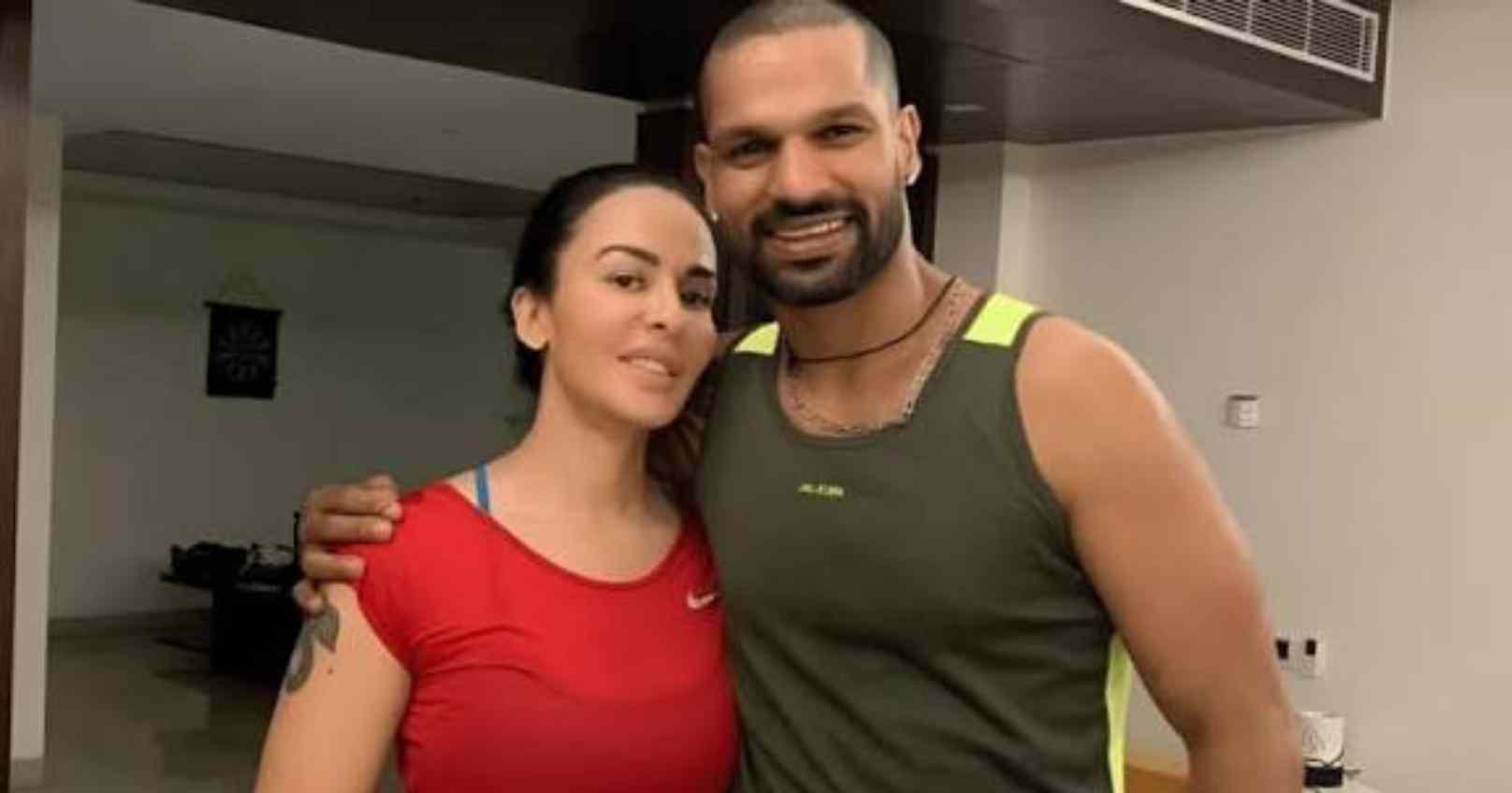

A Delhi family court has ruled that the Australian property settlement between cricketer Shikhar Dha

Read More

The Supreme Court has advised political parties to avoid using the judiciary for electoral rivalries

Read More